© 2023 Dr Margaret Sheppard

Organisation and Structure

The bank is owned by its members. RWDS members become JBS members by purchasing a total of 500 shares which they do by paying 10 rupees a week for 50 weeks. After they have purchased 120 (i.e. after 12 weeks) they are

able to start applying for loans. Members are also encouraged to build up savings in their local bank. These individual savings are recorded in their special JBS savings books. The bank staff collect the member’s savings and deposit them in the JBS bank account in a local branch of a commercial bank. Members have easy access to these savings as their JBS will be much nearer than their nearest commercial bank and their local JBS accepts deposits and withdrawals from as little as 5 or 10 rupees. Members’ children are also encouraged to save in special Children's Savings Accounts and more recently non-

Savings accounts are an important aspect of the Janashakthi Bank Societies and all members are issued with the special JBS savings books. These earn interest -

So much for providing the poor with local savings and banking facilities. The other problems that the JBS set out to address was the provision of credit facilities to members. This is provided through the small loan system. The loans

are of various types. Disaster loans cover emergencies such as in times of family illness, serious damage to housing during storms etc.. Cultivation Loans are to assist members to develop their rice paddies and chenas. Fishing Loans assist fishing families to attain a higher share of the catch (e.g. if they are able to buy a net, or perhaps even a share in a fishing boat they are thus able to qualify for a larger share). Self employment and Small Business Loans allow members to develop business enterprises. Some JBSs have Consumption Loans to enable members to buy food.

As members very rarely have any collateral a unique system of guarantees has been developed. Members form themselves into groups of five neighbours or friends. These 5-

Each JBS is composed of 5 to 7 RWDS groups (i.e. 250-

The JBS started up as a bank without buildings. One of the members of each society allowed their JBS use of a room in their own house -

The daily business was run by two staff -

Board and the Zonal Bank Secretary who regularly checks the financial records.

The Administrative Board of a JBS outside their bank which is in a spare room of the house behind them. This house is the home of one of the members

When a Loan application is approved the member signs for it and receives the money. The repayments are made with 3% interest per month at their local JBS. The sizes of the loans vary according to type and individual local society. For example in 1994 small business loans varied from 1000-

Loan repayment rates were very high, 98-

It should be noted that although only women can become members of their JBS and only women can take loans, they are allowed to take loans on behalf of members of their families. For example wives often take loans for their husbands, e.g. for their carpentry, building or fishing enterprises, or a sister may take a loan for a brother's paddy field etc..

A member signing receipt for her loan

A husband repaying some of wife’s loan

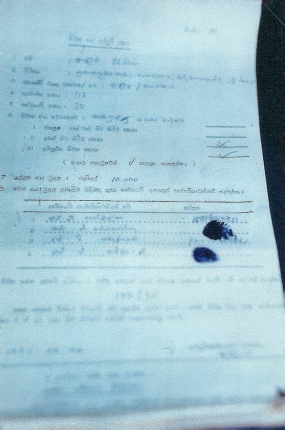

Loan application form. In 1994 there were still many adults who were illiterate like this member. She has signed for receipt of her loan with thumb prints.

Member checking amount outstanding on her loan

JBS Administrative Board meeting to discuss loan applications forwarded by their local 5-

All members are enrolled in a Group of Five fellow women -

They will discuss and share micro business ideas and then if a member needs to take out a loan from the local JBS, they will each sign to guarantee the repayment of the loan on the application form. The Social Mobilizer attached to their local RWDS group often attends these weekly meetings to offer further assistance and advice from her knowledge gained from training provided by WDF courses and discussions. These mobilizers offer support where needed they never IMPOSE their own ideas.

If one of the members needs help in e.g. digging out a pit latrine, mending a roof or making bricks etc,, the fellow members and their husbands will assist.

The 5 Group is the grass root of the Janashakthi Movement to relieve poverty and promote development and in December 1993 there were 3729 Groups of Five. It is these members who identify their problems and the help they need to overcome them. Nothing is imposed on them. For example they identified health issues and the difficulty of accessing medical care. This led to talks at RWDS meetings on e.g. Public Health, Nutrition, Family Planning and a regular mobile clinic attending at the Temple to identify and treat individuals and refer and encourage if necessary, to the hospital or specialist clinics such as cataract removal provided by Overseas charities such as Sight Savers.

The Groups of Five (5 Group)

5 Group weekly meetings, typically attended by the local Social Mobilizer to offer support and advice when asked. Minutes are carefully recorded and the accounts of Group Savings. Group Purchases at wholesale prices of household necessities are also distributed, and ideas shared. Thus no member suffers social isolation.